Photo illustration: r/personalfinance vs r/financialindependence

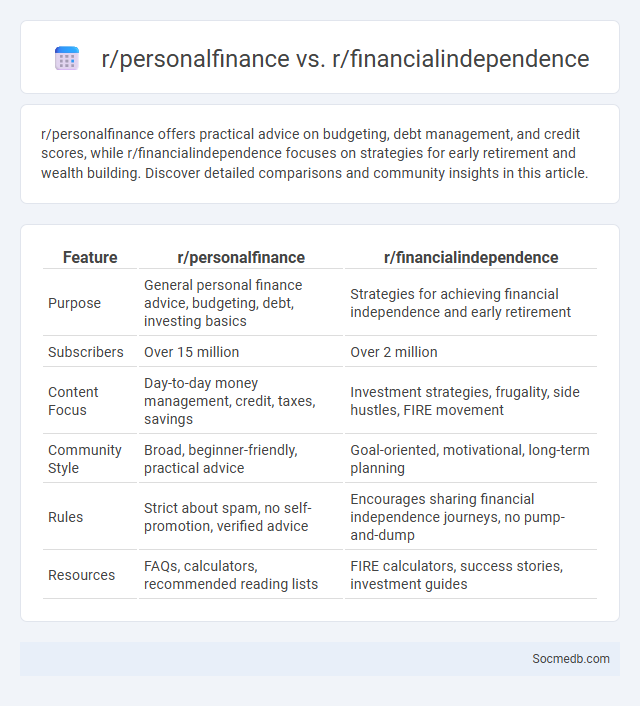

r/personalfinance offers practical advice on budgeting, debt management, and credit scores, while r/financialindependence focuses on strategies for early retirement and wealth building. Discover detailed comparisons and community insights in this article.

Table of Comparison

| Feature | r/personalfinance | r/financialindependence |

|---|---|---|

| Purpose | General personal finance advice, budgeting, debt, investing basics | Strategies for achieving financial independence and early retirement |

| Subscribers | Over 15 million | Over 2 million |

| Content Focus | Day-to-day money management, credit, taxes, savings | Investment strategies, frugality, side hustles, FIRE movement |

| Community Style | Broad, beginner-friendly, practical advice | Goal-oriented, motivational, long-term planning |

| Rules | Strict about spam, no self-promotion, verified advice | Encourages sharing financial independence journeys, no pump-and-dump |

| Resources | FAQs, calculators, recommended reading lists | FIRE calculators, success stories, investment guides |

Introduction to Financial Subreddits

Financial subreddits on platforms like Reddit provide a dynamic space where investors, traders, and enthusiasts share insights, strategies, and real-time market updates. These communities cover a diverse range of topics including stock analysis, personal finance tips, cryptocurrency trends, and investment opportunities. Engaging with these subreddits can enhance your understanding of financial markets and help you make more informed decisions based on collective knowledge and discussions.

Overview of r/personalfinance

r/personalfinance is a popular subreddit dedicated to advice on budgeting, investing, and debt management, with over 15 million members sharing practical tips and financial strategies. The community emphasizes responsible financial habits, offering resources for retirement planning, credit score improvement, and emergency fund creation. By engaging with r/personalfinance, Your financial literacy can significantly improve through real-world discussions and expert-backed guidance.

Overview of r/financialindependence

r/financialindependence is a vibrant subreddit dedicated to discussions on achieving financial independence and early retirement (FIRE). It features user-generated content including personal finance strategies, investment advice, and real-life case studies on saving rates and passive income streams. The community supports over 1 million members, making it a leading resource for practical tips on budgeting, wealth-building, and lifestyle design through financial freedom.

Core Differences Between r/personalfinance and r/financialindependence

r/personalfinance primarily offers practical advice on budgeting, debt management, and credit scores, focusing on improving Your current financial health. In contrast, r/financialindependence emphasizes strategies for achieving early retirement through aggressive saving, investing, and passive income. Both communities provide valuable insights, but r/personalfinance caters to everyday financial challenges while r/financialindependence targets long-term wealth building and freedom.

Community Culture and Moderation Styles

Social media platforms foster diverse community cultures ranging from supportive networks to niche interest groups, shaping user interactions and content dynamics. Effective moderation styles, including proactive, reactive, and hybrid approaches, play a critical role in maintaining respectful communication and reducing harmful behavior. Understanding the interplay between community norms and moderation policies enhances user engagement and platform safety.

Popular Topics and Frequently Asked Questions

Popular social media topics include trends like influencer marketing, algorithm changes, content creation strategies, and data privacy concerns. Frequently asked questions often address how to grow your audience, optimize engagement, and navigate platform policies effectively. Understanding these key areas helps you maximize your presence and impact across different social media channels.

Resources and Tools Shared on Each Subreddit

Each subreddit offers a unique collection of resources and tools tailored to its community's interests, providing valuable links, downloadable files, and expert advice that enhance your knowledge and skills. For example, r/learnprogramming features coding tutorials and debugging tools, while r/fitness shares workout plans and nutrition guides. These curated materials empower you to access specialized content and connect with practical support directly within each subreddit.

Success Stories and Community Achievements

Social media platforms have propelled countless success stories by enabling entrepreneurs to reach global audiences and build thriving brands, exemplified by influencers who turned personal content into lucrative careers. Community achievements on social media highlight collaborative efforts, such as crowdfunding campaigns raising millions for social causes and grassroots movements driving significant social change. These platforms foster engagement, amplify diverse voices, and create opportunities for individuals and groups to transform ideas into impactful realities.

Pros and Cons of Participating in Each Subreddit

Participating in each subreddit offers targeted communities tailored to specific interests, fostering detailed discussions and resource sharing that enhance knowledge and engagement. However, subreddit dynamics can lead to echo chambers, biased opinions, and potential exposure to misinformation, impacting users' perspectives negatively. Moderation quality varies, affecting the community experience by either maintaining respectful discourse or allowing toxic behavior to flourish.

Choosing the Right Subreddit for Your Financial Journey

Selecting the right subreddit for your financial journey is crucial for accessing tailored advice and community support relevant to your goals. Focus on subreddits with active members, positive engagement, and content specific to your interests such as investing, budgeting, or debt management. Engaging in these focused forums can enhance your financial knowledge and provide timely insights to help you make informed decisions.

socmedb.com

socmedb.com