Photo illustration: Mid vs Fire

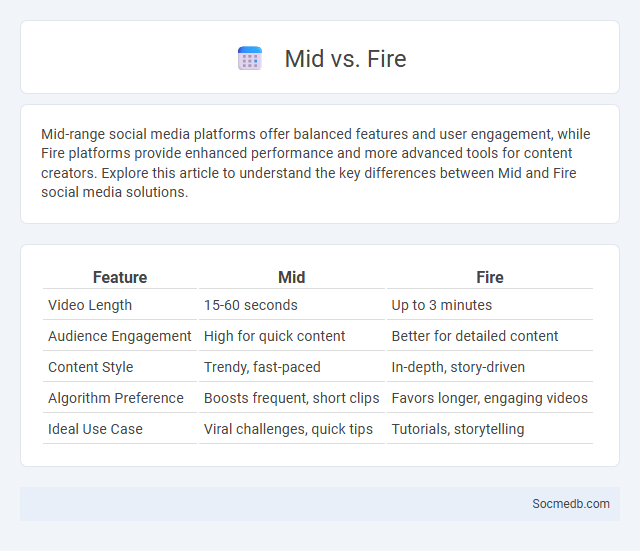

Mid-range social media platforms offer balanced features and user engagement, while Fire platforms provide enhanced performance and more advanced tools for content creators. Explore this article to understand the key differences between Mid and Fire social media solutions.

Table of Comparison

| Feature | Mid | Fire |

|---|---|---|

| Video Length | 15-60 seconds | Up to 3 minutes |

| Audience Engagement | High for quick content | Better for detailed content |

| Content Style | Trendy, fast-paced | In-depth, story-driven |

| Algorithm Preference | Boosts frequent, short clips | Favors longer, engaging videos |

| Ideal Use Case | Viral challenges, quick tips | Tutorials, storytelling |

Introduction to Mid, Fire, and Meme Tokens

Mid, fire, and meme tokens represent distinct categories of social media-based cryptocurrencies driving community engagement and digital economies. Mid tokens often serve as entry-level assets with moderate demand, fire tokens capture trending market attention through rapid value fluctuations, and meme tokens leverage viral content to fuel speculative investment. Understanding these token types highlights their impact on decentralization, social interaction, and the evolving landscape of online financial ecosystems.

Defining Mid Cap, Fire, and Meme Coins

Mid Cap cryptocurrencies represent digital assets with a moderate market capitalization, typically ranging between $1 billion and $10 billion, offering a balance of growth potential and stability. FIRE tokens are specialized digital assets designed to support financial independence and early retirement strategies within decentralized finance platforms. Meme coins are social media-driven cryptocurrencies that often gain popularity through viral trends and online community engagement, which can significantly impact Your investment decisions due to their high volatility and speculative nature.

Historical Growth of Mid vs Fire vs Meme Tokens

The historical growth of social media has significantly affected the popularity of Mid, Fire, and Meme tokens, with Fire tokens showing the most rapid rise due to viral content and influencer endorsements. Mid tokens experienced steady, organic growth tied to consistent community engagement, while Meme tokens saw volatile spikes aligned with trending internet culture and social media memes. Your investment strategy should account for these distinct growth patterns influenced by social media dynamics.

Market Volatility: Fire vs Meme vs Mid

Market volatility in social media stocks like Fire, Meme, and Mid dramatically impacts investment strategies due to their rapid price fluctuations influenced by user engagement trends and viral content. Understanding the distinct volatility patterns of these companies helps you anticipate market shifts and manage risk effectively. Analyzing historical data and social sentiment provides key insights for optimizing your portfolio amid the dynamic social media landscape.

Utility and Use Cases: What Sets Each Apart?

Social media platforms excel by catering to distinct utility and use cases, such as Facebook's emphasis on community building and event coordination, Instagram's visual storytelling and influencer marketing capabilities, and LinkedIn's focus on professional networking and career development. Twitter stands out for real-time news updates and public discourse, while TikTok revolutionizes short-form entertainment and viral trends. These specialized functionalities shape how users engage, business strategies, and content creation models across diverse demographics.

Community Support and Hype Dynamics

Social media platforms amplify hype dynamics by enabling rapid content sharing and viral trends, fostering enthusiastic community engagement around brands, events, or causes. Strong community support emerges through interactive features like groups, comments, and live streams, which encourage authentic dialogue, peer validation, and collective problem-solving. This synergy between hype and support fuels continuous engagement cycles, boosting brand loyalty and driving grassroots advocacy.

Investment Risks: Mid vs Fire vs Meme Coins

Investment risks vary significantly between mid-cap coins, FIRE tokens, and meme coins, with mid-cap assets offering moderate volatility and more established projects, while FIRE tokens present higher risk due to niche market appeal and regulatory uncertainties. Meme coins are the riskiest, driven primarily by social media hype and lacking fundamental value, leading to extreme price fluctuations and potential losses. Your strategy should carefully assess the trade-off between potential gains and volatility associated with each coin type to manage risk effectively.

Regulatory Perspectives on Mid, Fire, and Meme Tokens

Regulatory perspectives on social media tokens such as Mid, Fire, and Meme tokens vary significantly across jurisdictions, reflecting concerns over market manipulation, consumer protection, and compliance with securities laws. Governments and regulatory bodies emphasize the need for transparent disclosure, lawful issuance, and anti-fraud measures to mitigate risks associated with these highly speculative digital assets. Regulatory frameworks increasingly focus on classification criteria for these tokens to determine their status under financial regulations and to enforce appropriate oversight.

Long-Term Potential and Future of Each Category

Social media platforms like Facebook, Instagram, and Twitter exhibit long-term potential through continuous innovation in user engagement and monetization strategies. Emerging categories such as short-form video (TikTok, Reels) show rapid growth driven by algorithmic personalization and content virality, indicating future dominance in digital marketing. Niche platforms specializing in audio (Clubhouse, Twitter Spaces) and professional networking (LinkedIn) are set to expand by enhancing community-building and remote collaboration features.

How to Choose Between Mid, Fire, and Meme Coins

Selecting between mid cap, fire, and meme coins requires analyzing market capitalization, community engagement, and volatility levels. Mid cap coins offer moderate risk with balanced growth potential, fire coins typically exhibit rapid price surges driven by hype, and meme coins rely heavily on social media trends and viral marketing for value spikes. Evaluating project fundamentals, developer activity, and social media sentiment can optimize decision-making in the volatile crypto environment.

socmedb.com

socmedb.com